Legal Spend Management for Corporate Law Departments

A guide for Legal Departments on how to cut down Outside Counsel costs

Introduction

It is a Law Department’s mission to solve legal problems. The reality behind this mission is that it must be accomplished within the boundaries of the corporate profit motive. Unsurprisingly, most Legal Departments are judged on financial performance. Survey after survey has shown that management of legal spend is far and away a General Counsel’s single biggest concern.

When legal cost containment comes under scrutiny from CEOs and CFOs, the GC is challenged to come up with ways to accurately forecast and budget legal expenditures, manage resources, optimize financial outcomes and demonstrate the results of her department’s efforts.

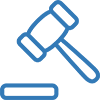

According to the Altman Weil 2018 Chief Legal Officer Survey

Chief Legal Officers (CLOs) spend 37% of their time advising their organizations’ executives, 22% practicing law, 20% on other corporate responsibilities and just 18% of their time managing the law department… However, despite the limited time allotted to the role, CLOs describe a growing expectation from CEOs that the law department will be run like a business unit.

What is Legal Spend Management?

Legal Spend Management (also “LSM”). LSM refers to a methodology that corporate Legal Departments develop and follow to control costs, manage legal resources and analyze spending trends.

There are any number of techniques that legal managers can use to keep costs down, but in the end, they all rely on good data. As the saying goes, ‘If you can’t measure it, you can’t manage it.’

Data driven LSM

Historically, difficulties gathering and isolating expense data left in-house attorneys to make strategic decisions by guesstimating. Providing Legal Departments with better financial data became one of the principal goals of Legal Spend Management, and LSM technology emerged to support that goal.

These solutions now allow businesses to collect and analyze legal cost data efficiently and timely and then use that data to empower legal decision making.

What types of businesses use Legal Spend Management technology?

LSM technology is not a new phenomenon. LSM systems have been in common use at larger corporations for well over a decade. The trend started in the United States where legal expenditures are a much larger percentage of GDP than in countries. Successful results led overseas subsidiaries and entities to follow suit, particularly in the EU and Commonwealth countries.

The trend now extends to smaller and midsize Legal Departments[1] where appropriately scaled and specialized LSM systems are becoming more common.

Why are Legal Spend Management systems focused on billings?

The lion’s share of the typical corporate legal budget is allocated to expenditures for outsourced services. Most of this goes to outside counsel for legal fees. A smaller but growing share goes to alternative service providers such as e-discovery vendors, document review firms, due diligence providers and IP management services.

As a consequence, a great deal of Legal spend management technology is devoted to the management of bills received from outside counsel and alternative providers (collectively “Legal Service Providers”). Given the focus on invoice management, LSM software is commonly marketed as E-billing Systems or Solutions.

How does automated E-billing help?

It provides up-to-date or even real-time information about the financial status and progress of specific matters that can be rolled-up for flexible departmental or company reporting.

The system can also be configured to notify the Legal Department about critical events, such as a matter that is reaching a billing or insurance threshold, budget-to-actual anomalies, non-conforming and missing invoices or line item billing issues such as unusual amounts and unnecessary charges.

How do E-billing Systems advance Legal Spend Management goals?

The second objective involves analyzing the collected data via reports and dashboards, focusing on the Key Performance Indicators (“KPIs”) that are most helpful to the management of legal functions.

What are the mechanics of E-billing?

It has become regular practice for companies using E-billing solutions to mandate that outside legal providers submit electronic invoices and budgets that feed data directly into their systems. The results supersede the labor-intensive processing of invoices that would otherwise have been received in paper-form or as email attachments.

Instead, the Legal Service Provider simply digitizes its invoices and submits them to the client through a web or e-commerce interface.

The invoices are submitted in a pre-defined, machine-readable format – usually as a spreadsheet or text file. The E-billing System checks the invoice file for formatting and content errors and kicks out non-complying invoices for correction. Once the discrepancies have been cleared up, the system will upload the invoice data for further administration and analysis.[1] When the process is complete, data from the invoices is available for LSM decision making.

What are the benefits of using an E-billing system?

♦ E-billing Systems lead to considerable time-savings. They automate tasks that would otherwise require hours of manual labor. Gone are the days of assigning a staff attorney, financial analyst or vendor to pour over line-item detail on legal bills.

With an E-billing Solution, routine and repetitive auditing tasks are handled by a computer. Issues are flagged by the system and digital notifications sent to in-house staff or outside providers. Workflow logic streamlines the routing and escalation of authorizations and of other tasks that require a person to intervene.

As a result, Legal Department attorneys and staff are freed up to spend time on more substantive matters.

♦ Billing surprises effectively go away. Inaccuracies and anomalies are caught and addressed at the time of invoicing. The system flags problems that previously would have gone undetected or that would have taken months to find.

Discrepant bills are identified programmatically and sent back to the provider for correction before the system accepts them. As a result, attorneys can actually rely on matter budgets to make timely management decisions, and overall departmental spend becomes more predictable.

How do law firms benefit?

They allow law firms to set up standard billing templates by client or matter. As a result, firms tend to view any encumbrances of E-billing as offset by shortened payment cycles, a reduction in billable time wasted investigating and fixing invoicing problems and avoidance of conflicts that eat away at client goodwill.

Please click on the button to evaluate your needs for Legal Spend Management

How are LSM reports and dashboards used?

To operate effectively in-house counsel needs accurate financial data to support corporate decision making and to examine and justify the decision in the face of cut-to-the-bone cost savings initiatives.

When we talk about LSM reporting, the conversation extends beyond conventional, bland six-column reports, that sit on the desktop, challenging the user to tease out critical findings. The better LSM systems incorporate advanced level analytics that draws the user to the most important information for the right decisions.

The system presentation interfaces are flexible and can be modified to specific corporate needs. Information can be presented for executive decision making via graphical dashboards with drill-down capabilities. It can also be presented in table format with charts and graphics or as highly detailed spreadsheets for analysts.

The bottom line is that ‘actionable data’ needs to be identified, located and presented at levels appropriate to the needs of the users.

What are some benefits of enhanced reporting and KPIs?

In this section we will explore some of the ways, a General Counsel is able to control cost with the help of LSM data. We will also discuss ways that KPI metrics can be used to improve legal management and decision making.

Case Study 1: Deciding whether to outsource?

To help in reaching a conclusion, the Law Department staff consult the LSM system. Relevant billing data we aggregated and a dashboard presentation is created. The results are used in meetings with the GC and Accounting. The dashboard presents various KPIs from the last 8 quarters, including:

♦ Research hours and dollars charged by the law firm

♦ Average hourly rates by the firm and by biller level

♦ Comparisons to effective internal resource rates and the rates of offshore providers.

The results are presented in color pie and bar chart formats and in summary tables. The dashboard is also set up for interactive drill-down. The GC and other users can click on numbers or graphical objects to pull up underlying detail.

The results are used by the Law Department and Accounting to make decisions about whether to shift work to a law firm with attractive rates, outsource the work to an offshore firm or assign it to internal staff members.

According to the Altman Weil Chief Legal Officer Survey, in 2018

For the first time, the survey found that internal spend represented the greatest portion of the total budget, with an average allocation of 48% of total budget going to in-house spend, 45% to law firms, and 6% to other non-law-firm vendors.

Case Study 2: Monthly budget forecasting

In this case, the General Counsel is tired of being routinely brow-beaten by the CEO and CFO for inaccurate budget forecasts. A new E-billing System is implemented. The company works with its Legal Service Providers and electronic invoicing begins.

Historic legal billing data is converted and imported from various corporate legacy systems. Within several months the Law Department is able to generate more accurate budget-to-actual reports.

Additionally, KPIs such as the top 10 billing matters, significant matter budget variances and average monthly spend by the law firm are tracked. The benefit? When the General Counsel sees average monthly costs rising, she can pinpoint the causes, quickly take remedial steps and notify the CEO and CFO. Similarly, when numbers are coming in under budget, she is able to showcase Law’s performance to upper management.

Finally, outside counsel spend data is analyzed and used to negotiate favorable rates with the law firms.

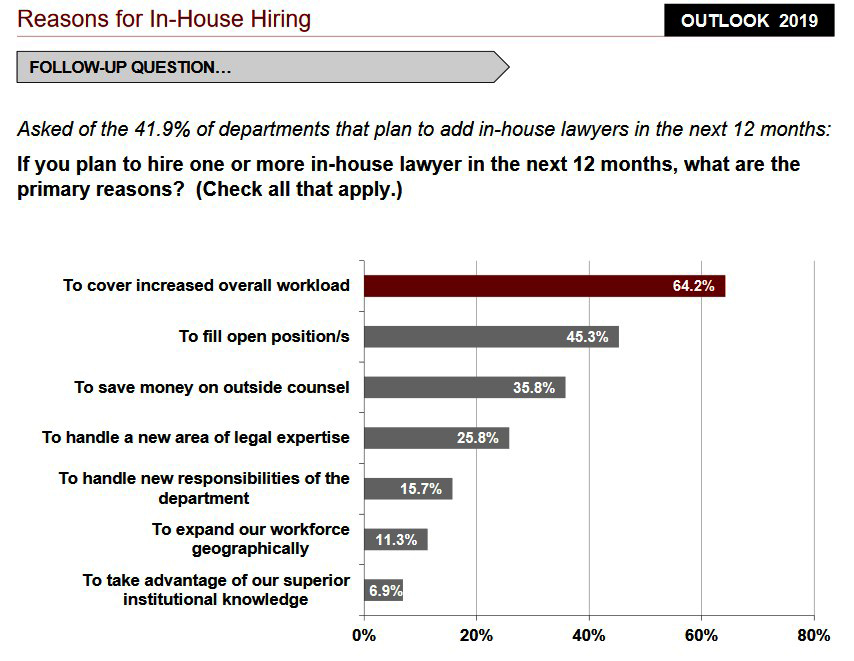

Case Study 3: Cost comparison of outside lawyers vs. in-house staff

The increase is attributable to an increase in casework, but it is determined that over half the spend for that firm is going to routine immigration filings. Management concludes that adding a Labor Paralegal to handle the filings will result in approximately $340,000 in annual savings. Information from the software is used to prepare an ROI report for Corporate.

Case Study 4: Litigate vs. settle decisions

The new head of Marketing is frustrated over the number of products infringing on company trademarks. He consults with in-house IP counsel about stepping up enforcement actions and suggests that the company adopt a ‘win-at-any-cost’ strategy.

The infringements are not a new problem for the company, but the General Counsel asks the IP attorney to give the topic a fresh look. The IP lawyer uses the LSM system to pull the last five years’ data for infringement matters.

She is then able to cross-index the cost data with information from the company’s matter management system (e.g. case outcomes, recovery amounts, resolution types, party types, jurisdictions). She works with a financial analyst and creates a set of spreadsheets calculating such KPIs as the shelf life for infringement matters, legal fees by stage and in total and recovery amounts.

These KPIs are cross-indexed with the matter management data by date for more granular analysis. The results are tied to relevant sales data for additional insight. The results presented to the CMO and GC and ultimately used to create an updated enforcement model based on likely outcomes.

Why are E-Billing guidelines critical to success?

These guidelines should include corporate legal billing requirements such as permitted timekeeper roles (i.e. appropriate tasks for partners, associates, Paralegals and support staff), acceptable billing rates, maximum hours allowed by UTBMS task (e.g. contract drafting, patent filings, depositions, court appearances)and travel and expense rules.

The better E-billing Systems are already programmed to apply rules from the guidelines. Once Billing Guidelines are agreed upon between the Legal Department and the Legal Service Provider, the next steps can be as simple as configuring and activating the predefined system rules and running test invoices.

After this, the Legal Service Provider would start submitting conforming invoices for E-billing processing.

As the invoices are uploaded into the E-billing System, the software automatically evaluates each submission, down to its line item detail, by applying the billing rules.

If an inconsistency is found, the system workflow could be set up, as noted above to reject the invoice, prominently flag the item(s) and notify the Legal Service Provider and the appropriate in-house attorney or staff member so that the reconciliation and correction process can be quickly completed.

The following are two examples of how the Billing Guidelines could be incorporated into the E-billing System logic to avoid common invoicing errors.

Scenario 1

A Legal Department and ABC law firm agree upon the billing rates for a new litigation matter. Paralegal rates are set at $60/hour. However, as the case progressed, ABC consistently invoiced Paralegals at $140/hour. The in-house attorney assigned to the matter and working under a heavy caseload missed the inconsistency.

To that attorney’s chagrin, the problem was only identified after the General Counsel complained that the litigation was well over budget. Upon review, it was discovered that the law firm had incorrectly billed the Legal Department for over sixteen months. A time-consuming and distracting negotiation ensued to resolve the issues.

Had this legal Department been using an E-billing system the allowable billing rates would have been pre-set in the software. The over-billing would have been flagged with the first discrepant billing and fixed relatively easily without the retroactive hassling.

Scenario 2

Spend management reports and dashboards are just one way to contain costs. A robust E-billing system is capable of identifying and triggering alerts at critical stages. In the past, the General Counsel has been burned because budget overruns were not discovered until months after the fact.

After an E-billing System is implemented, the General Counsel assigns a budget of $100,000 to a newly created matter. The system is configured to send her a notification email when the matter spend exceeds $70,000.

The idea is to ensure that overruns do not fly under the radar and that the GC has time to react before the budget is blown. Once the threshold is achieved, she will receive the notification and can use the system for a detailed analysis of matter spend.

What are some other benefits of an E-billing System?

♦ Once a Legal Department starts using an E-billing System, its Legal Service Providers quickly come to understand that their invoices are being reviewed. Since billing errors are being noticed, law firms tend to become more diligent in following billing Guidelines.

In the end, the law firms and vendors self-police their invoicing and ‘administrative’ billing errors are minimized.

♦ Legal Departments are able to evaluate legal provider performance periodically or over the life of an individual matter with just a few clicks. Standard reports and dashboards can be developed to make this kind of analysis easier and routine.

♦ Legal Departments are equipped with better financial data to highlight budgetary concerns in meetings with the CEO and CFO. They also have better data to convincingly support requests to increase department budgets.

♦ Legal Departments have better data to develop outside counsel retention and management guidelines, to negotiate provider rates, to redistribute work and to make in-source vs. outsource decisions.

♦ The software does the heavy lifting work of reviewing each and every billing line item. Mistakes are reduced, surprises are avoided, and in-house attorneys and staff are freed up for more productive tasks.

One last note

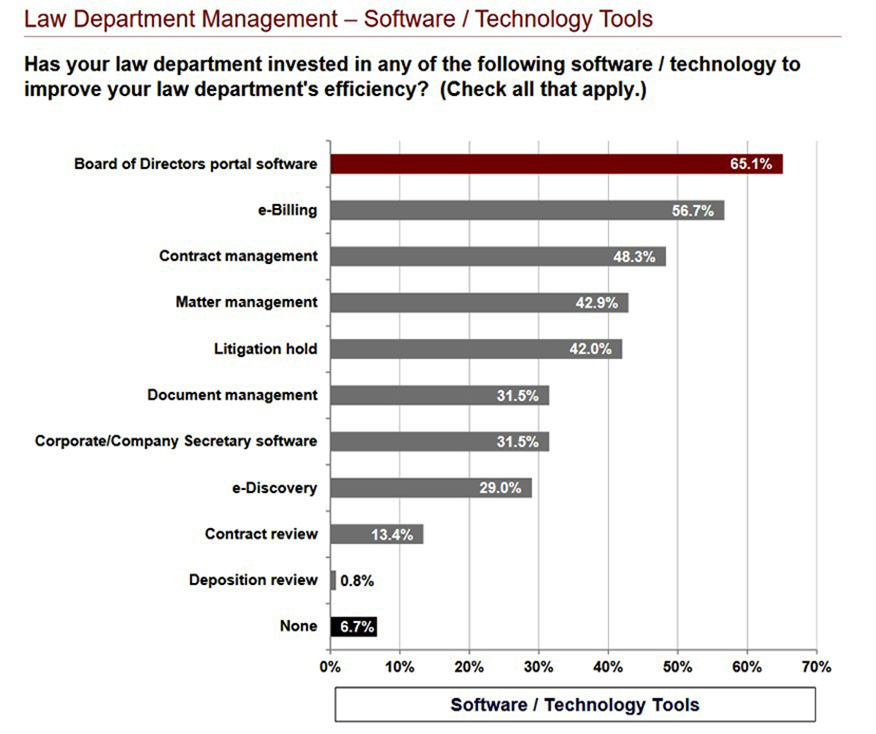

We hope the information contained in this guide helps you with your LSM questions. Our final recommendation is to look for an E-billing System that integrates with matter management, contract management, and document management systems, preferably as one unified product.

You will benefit from integrated reporting and analysis capabilities, and you will spend less time and money learning system operations.