e-Billing System for Corporate Legal Departments

A comprehensive guide for In-house Counsel looking for legal billing solution

What is e-Billing?

Let’s debunk the myths first. e-Billing systems are equally beneficial to Legal Departments of ‘all sizes‘ that use outside counsel. Electronic billing (e-Billing) is a way to deliver or present invoices to clients electronically, rather than by snail mail-in paper form. Electronic bills allow bill delivery to take place online.

You do not need to be intimidated by the name. These systems can be reasonably priced and simple to implement. e-Billing is NOT an accounting module, nor it is used by your accounts payable.

It is strictly meant for the in-house reviewer whose job is to review the outside counsel invoice and approve or disapprove it for payment. The data from the invoice is captured automatically and then used to generate reports that help in-house counsel monitor and manage matter spend.

Those weighing the move to an e-Billing system must understand how the technology streamlines the legal billing function and the benefits that can be derived when moving away from a manual review process. The purpose of this guide is to define and explain the most important components of e-Billing. We will look at e-Billing systems and the processes and business goals they are designed to.

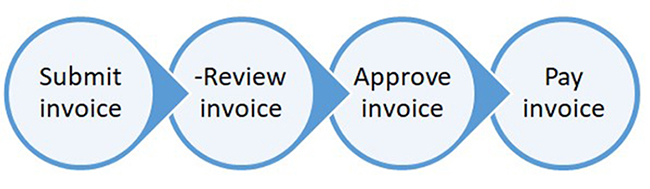

How Does e-Billing work?

A high-level summary of the e-Billing process is depicted below. The process starts with the outside counsel, who will simply upload the invoice to a highly secured web site. Once the invoice is uploaded, it will be transferred electronically to the Legal department’s in-house e-Billing database.

At that stage, the assigned reviewer will receive an automatic notification of the invoice receipt. This notification informs the reviewer that the invoice is available for review and approval.

The e-Billing system will flag errors automatically before the reviewer sees the bill. The reviewer will open the invoice and may focus on the flagged errors or review the time and expense entries, line-by-line.

After the invoice is approved, the reviewer can simply click a button to route the invoice to the Accounts Payable department for processing.

Why are Billing Guidelines Important?

The logic then draws on variables entered by department attorneys and staff at the time a new matter is set up (i.e. for billing rates, expense limits or other matter-specific criteria).

The rule logic is based on the Legal Department’s ‘Billing Guidelines’. These are published policies and procedures that outside counsel are required to follow when submitting invoices.

They are essentially a contract between the Legal Department and the law firm in which the latter agrees to comply with the invoicing protocols established by the former.

Establishing maximum hourly rates– by resource type for a particular case (e.g. rate caps for partners, associates and paralegals)

Setting caps– on the number of hours an attorney can bill for a particular task or stage (e.g. the attorney may not bill more than 40 hours at the rate of $200 an hour to file pleadings).

Placing limits on expenses– expense policies should be included as part of the Billing Guidelines (e.g. hotel expenses may not exceed $325 per night, no first-class air travel)

Defining acceptable time entries– requiring the law firm to bill in standardized, pre-defined increments (e.g. by the quarter-hour)

Mandating task-based billing – requiring that each line item on the bill be assigned a pre-defined task code. This is a critical requirement for effective cost management.

The American Bar Association (“ABA”) publishes and maintains a Uniform Task-Based Management System code set. These codes are commonly adopted by Legal Departments and law firms for task-based billing.

Once set up, the e-Billing system rules will examine each law firm’s electronic invoice applying the pre-established criteria from the guidelines.

If an invoice is non-compliant the system may flag the discrepancy and notify the in-house counsel or return the invoice directly to the law firm for correction.

Requiring the submission of task codes for line item billings will be critical to the success of downstream legal spend activities like budgeting, forecasting and corporate reporting. It also simplifies billing review.

This means that the Billing Guidelines must include a prohibition against bundled time entries. Bundling is the practice of listing a group of tasks in a block summary under a single task code. For example:

Draft interrogatory requests; telephone conference with Dr. Brown re: expert report; summarize deposition of Mr. Smith; review and revise correspondence to opposing counsel. (4.6)

Bundled time entries make it difficult for Legal Departments staff to understand what they are paying for or to use the billings as a reference point for future analyses. The e-Billing system can be configured to look for and reject bundled entries.

How do Law Firms Submit e-Billing Invoices?

Most of the law firm time & billing systems are already capable of generating invoices that conform to LEDES industry standards.

What is LEDES Format?

LEDES is an acronym for the Legal Electronic Data Exchange Standard. It is a file format specifically designed by and for the legal industry to facilitate electronic data transmission. It is a standard practice for outside counsel to submit invoices in LEDES format to companies that use e-Billing systems.

What Legal Departments Want from an e-Billing System?

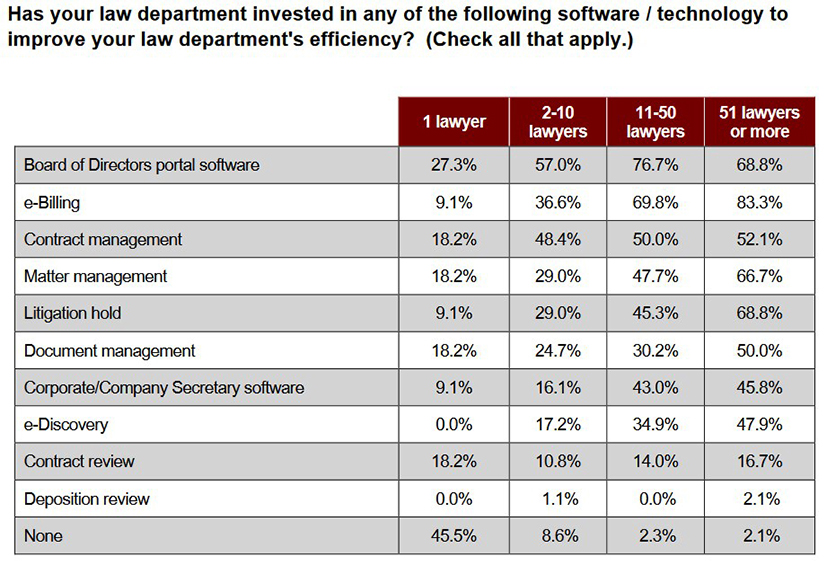

There are two types of companies that are searching for e-Billing software. The first group consists of organizations that are already using an e-Billing system and want to switch to another solution.

The second group is made up of organizations that are considering e-Billing technology for the first time. It is our experience that about 90% of buyers fall into the second category.

Having said that, in-house Legal Departments in either category want a system that is not overly complex, is easy to implement and does not break the bank. They want a system that streamlines the processing of outside invoices, helps them control costs and provides robust reporting.

These latter two functions are integral to legal spend management activities. The e-Billing system will serve as the point of capture for data that will feed a business’ cost control systems and processes.

Does e-Billing Require a Separate Software System?

There are two general systems development approaches to e-Billing. Some vendors incorporate e-Billing into their suite of legal operations tools. Other vendors offer e-Billing as a standalone application. Many of the standalone systems have narrowly defined feature sets, and require a great deal of custom integration to work effectively with case management or legal spend systems.

The better option is to look for a vendor that provides e-Billing, case management, contract management, document management and spend management as a unified suite.

These types of systems use a central database, which in turn cuts down on duplicative or inconsistent data and extra work steps.

They allow the Legal Department to aggregate and analyze data and create cross-function reports. They offer implementation and maintenance advantages because you will be working with a single vendor.

What are the Pros and Cons of Cloud vs. On-premise Solutions?

With an on-premises e-Billing system the entire platform needs to be built-out internally in a client data center. Hardware and software need to be acquired. Robust security controls must be established, and specialized staff needs to be dedicated and trained to administer all aspects of the system.

The costs and complexity can grow quickly. Since on-premises systems require more client expertise for maintenance and bespoke implementation, they generally have a total cost of ownership that is greater than cloud solutions.

On the other hand, cloud-based e-Billing systems do not need to be implemented from scratch. Users are up and running quickly, and there is little capital expenditure at the outset. Cloud systems let Legal Departments reap benefits from the get-go – and the CFO will be happy. So will the CIO.

The vendor will be responsible for providing IT infrastructure services like server and connectivity management, robust security controls, database administration and disaster recovery.

Since the vendor knows its system better than anyone, there should be minimal downtime and smooth transitions when new versions of the software are released.

Please click on the button to evaluate your needs for a e-Billing System

What Benefits Does e-Billing Software Provide?

Streamlines invoice submission. e-Billing establishes a standard invoice format and a standard format for time and expense entry descriptions.

It allows for the assignment of phase, task, and activity codes, which facilitates the legal spend analysis that occurs after payment of the invoice.

Automates invoice routing. e-Billing automates the routing of the invoice which serves to reduce the potential for invoices becoming lost in the mail or lingering on someone’s desk.

An e-Billing system can create pre-determined invoice routing assignments based on case/matter assignment, alert reviewers when an invoice is available for review, and provide the status of an invoice at any time; i.e., the location of the invoice in the workflow process.

Monitors billing rates and timekeepers. e-Billing technology can identify, and flag unapproved billing rates and timekeepers for each case. Both of these flags will ensure that the law firm is billing the Legal Department as agreed at the outset of the case.

Enforces outside counsel Billing Guidelines. e-Billing technology can enforce most billing rules the Legal Department establishes for its outside counsel.

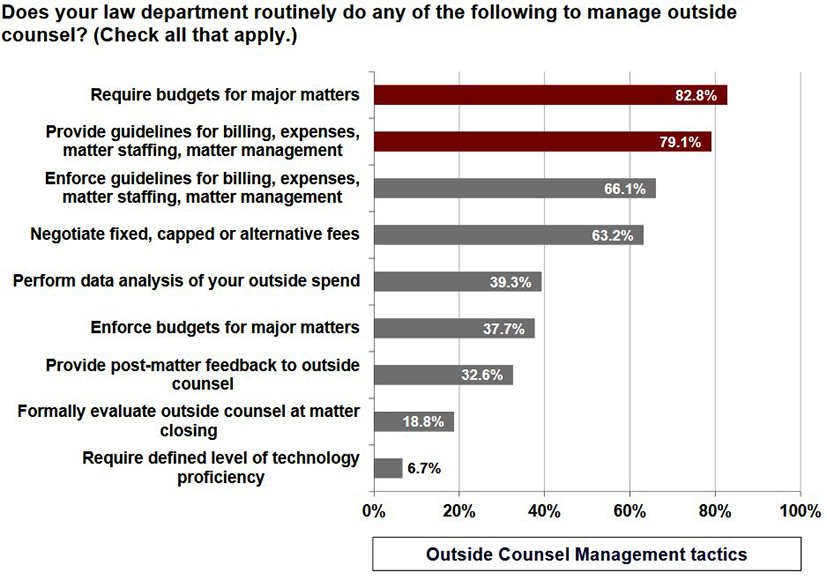

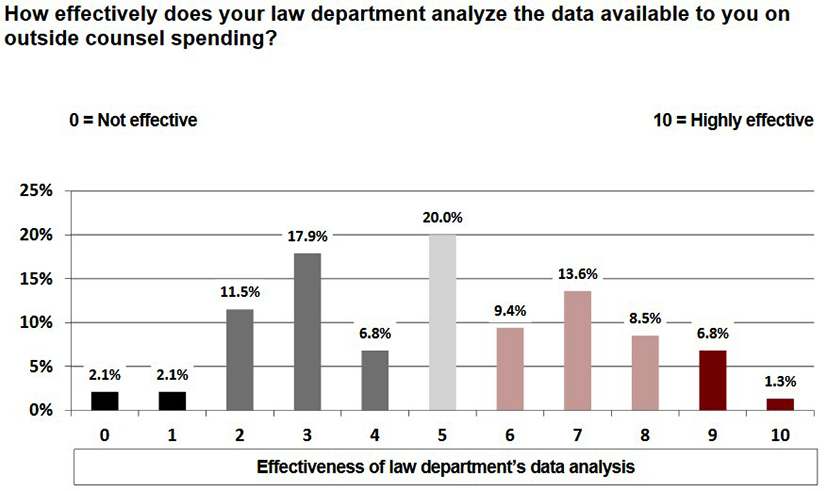

Consistent enforcement of Billing Guidelines ranks high among chief legal officers for reducing outside counsel legal spend.

Supports management of matter budgets. One of the most effective tactics to improve law firm performance is requiring and enforcing matter budgets.

Most e-Billing systems include a matter budget element in which law firms may enter the required budget information for a new matter.

As work is billed, the percentage of work completed and the amount of money spent to date will appear on the invoice review screen for each invoice. In this way, in-house counsel can monitor the budget as the work is performed.

What’s up and Why?

Problem: The general counsel of a five-attorney Legal Department sees that his outside counsel spend has been trending up for the past three years even though the number of cases opened during the same time period, declined.

During the past three years, his in-house legal team managed hundreds of cases of various types and in multiple jurisdictions. How can he get to the bottom of this mystery?

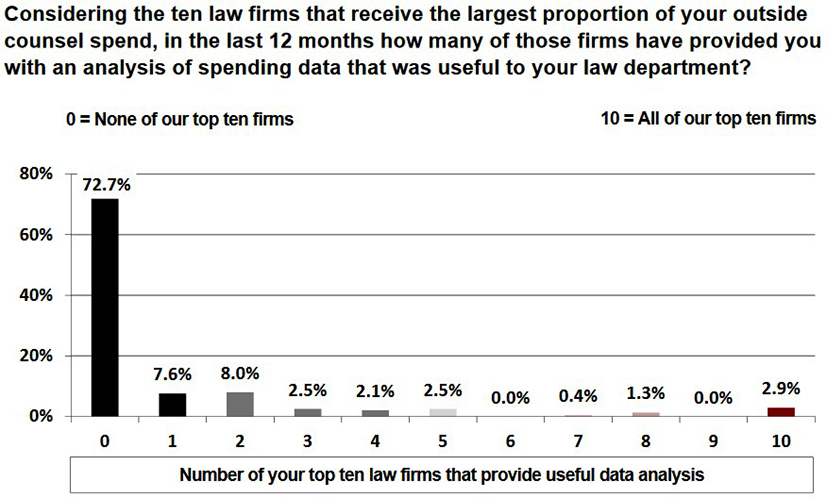

Solution: If this GC is using an e-Billing system, the data he needs to find the answer to this mystery can be easily obtained. e-Billing solutions typically provide analytical services for monthly, quarterly, and annual legal spend. Some may also provide trend reporting about outside counsel legal spend, along with the various components that impact the spend trending up or down.

Enables legal spend Analysis (Reports). The e-Billing system provides invoice data in a format that allows it to be aggregated, manipulated, and analyzed. Legal spend data gives the Legal Department the information it needs to manage its outside counsel spend.

Reduces outside counsel legal spend. Enforcement of outside counsel Billing Guidelines reduces cost, changes lawyer behavior, and changes the way law firms manage your matters.

Legal spend analysis provides you the information you need to make wise business decisions, regarding the selection of law firms or to develop strategies for matter files.

The 24-page invoice

The Problem: A young general counsel of a small business sits at her desk reviewing a twenty-four-page (paper) invoice from an out-of-town law firm she used on a non-routine case.

She is suspicious about the time spent on some of the tasks that are billed on the invoice. Other tasks might have been performed more than once. It will take hours for her to analyze the invoice manually.

The Solution: If this young GC used an e-Billing software, the e-Billing system would have flagged these discrepancies automatically thereby alerting the GC. Alternatively, the e-Billing software reporting and dashboarding capability would allow her to carry out an in depth analysis of the invoice data with few clicks.

Why Have Small to Mid-sized Legal Departments Been Slow to Adopt e-Billing?

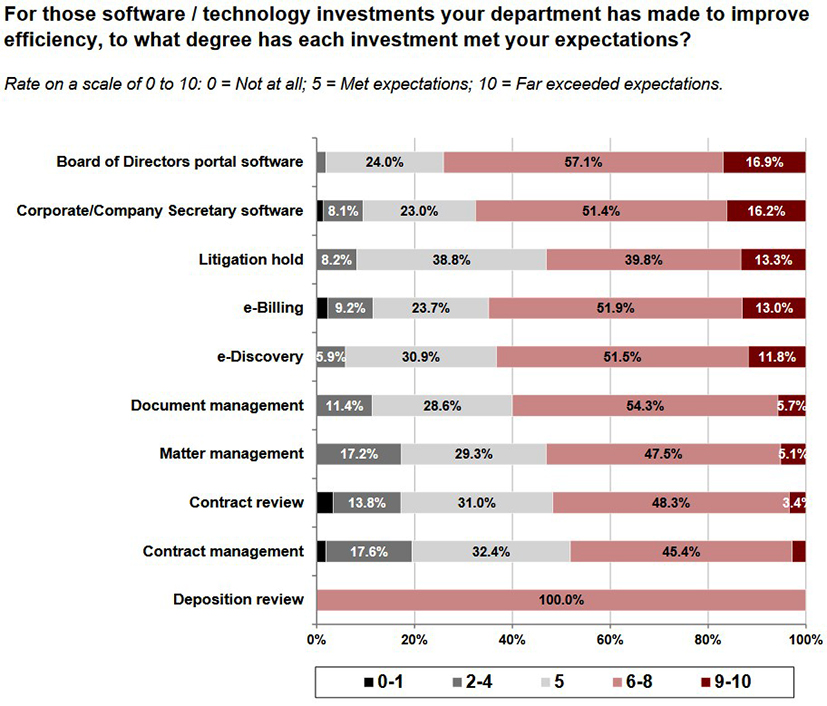

These are important goals for all Legal Departments regardless of size. While all departments share in these goals, they may not benefit equally from the same e-Billing solutions.

Many established e-Billing vendors cater to large Legal Departments that process hundreds of invoices on a monthly basis.

These systems typically are not suited to the needs of small to mid-sized operations. Smaller departments shied away from e-Billing because they encountered issues with the established solutions such as:

Laborious and lengthy implementation. The systems designed for larger organizations tend to be on-premises solutions that come with all the implementation concerns discuss previously.

A long learning curve. These systems can be complex and laden with features that are not appropriate for smaller operations. It will take extra time to train the law firms and in-house staff on the proper use of the system.

Mistakes will be made, and users will also become frustrated when wading through unnecessary screens and fields trying to find the ones they need.

Burdensome workflows. Larger organizations tend to be byzantine, necessitating multiple levels of billing review and management approval. The e-Billing systems that cater to this market have built-in workflows that will slow down a smaller Legal Department.

Pricing. You get what you pay for, but you do not need all that you get. The pricing for a large-firm system includes bells and whistles that a smaller organization will not use.

Fortunately, there is good news for small to mid-sized Legal Departments. A group of vendors that cater to this market segment has emerged. They offer complete legal operation solutions or stand-alone e-Billing systems.

At the same time, they are built with robust financial controls and security. Workflows are simplified and streamlined to fit the needs of smaller operations.

These solutions, particularly cloud-based offerings, can be implemented within a matter of days. Finally, the new e-Billing solutions are attractively priced.

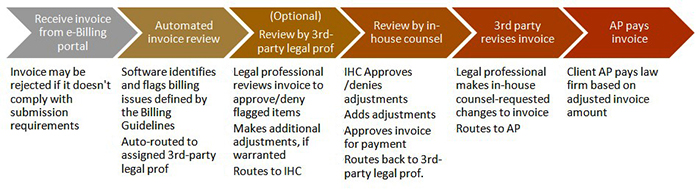

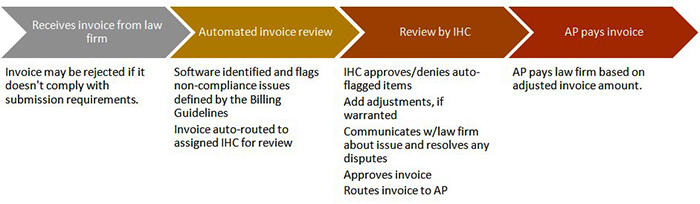

The charts below illustrate some of the differences in the workflow that would be encountered when using the two types of systems.

Large Firm e-Billing Systems

3rd party process moves invoice electronically between law firm, e-Billing vendor, and client.

IHC = in-house counsel.

Modern and Simple e-Billing solutions

The process takes place within the Legal Department. Law firm and Legal Department communicate directly and resolve billing issues in real-time. If the invoice has no flagged items or non-compliance issues, the in-house counsel may route the invoice directly to AP.

Conclusion

This has been an overall overview of what an e-Billing system and supporting guidelines can do for a Legal Department. We hope we have helped you identify focus areas and system features that will help as you search of an automated solution to streamline your legal invoicing process.